The form and the Procedure for filling out the Report by IHC countries have been updated

The State Tax Service of Ukraine reminds that on February 15, 2024, Order of the Ministry of Finance dated December 21, 2023, No. 709 "On Amendments to the Order of the Ministry of Finance of Ukraine dated December 14, 2020, No. 764" (hereinafter - Order No. 709), as amended by Order of the Ministry of Finance dated January 12, 2024, No. 12, came into force.

The amendments were made to bring it in line with the provisions of the Law of Ukraine dated 20.03.2023 No. 2970-IX "On Amendments to the Tax Code of Ukraine and Other Legislative Acts of Ukraine on the Implementation of the International Standard for the Automatic Exchange of Information on Financial Accounts".

This was reported on the web portal of the State Tax Service in the section: Home/Press Center/News.

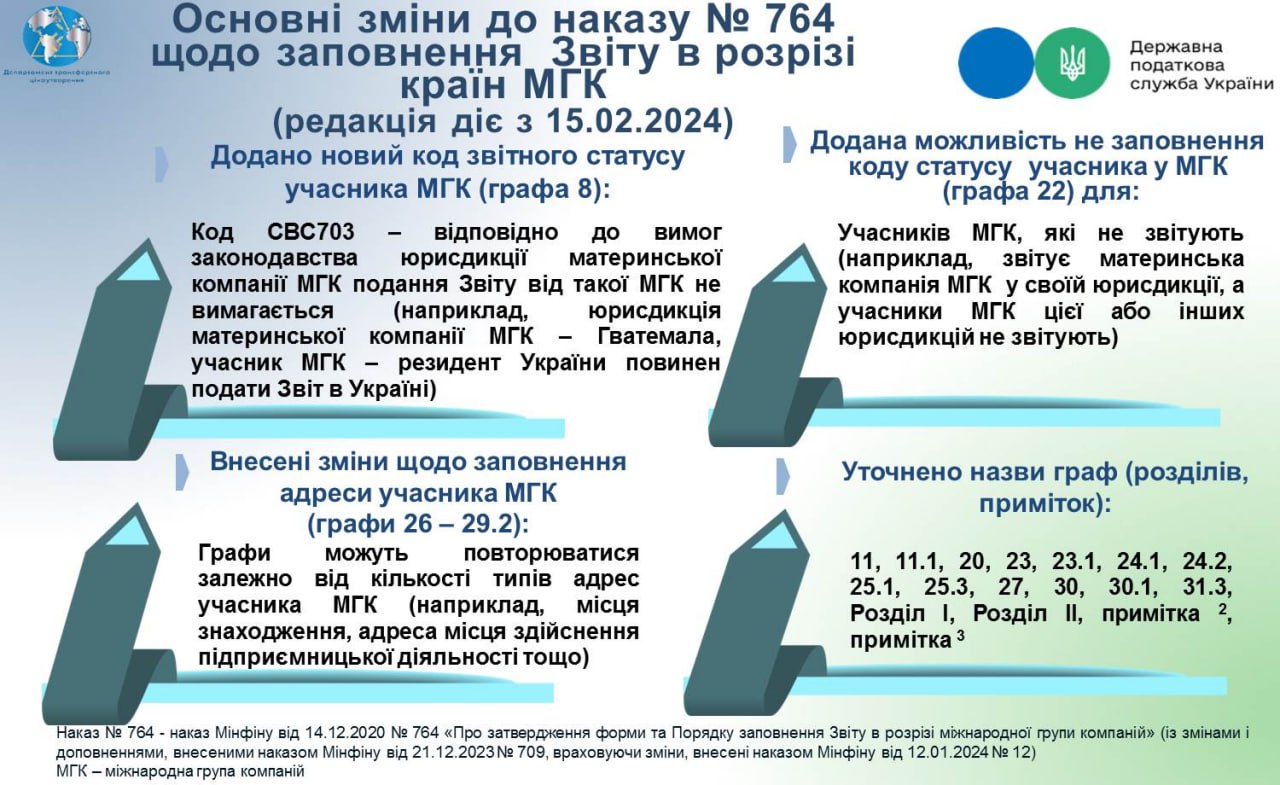

Among the main changes to the Procedure for filling out the Report by IHC countries are the following

- clarification of information on the book value of tangible assets (other than cash or cash equivalents, intangible assets, financial assets) of permanent establishments (to be reported as part of the information on the jurisdiction (state, territory) in which such permanent establishment is located)

- the need to repeat section II "List of members of the international group of companies in each jurisdiction (state, territory)" of the Report by IHC country in accordance with the number of IHC members for each such member that is a tax resident or subject to taxation as a permanent establishment in the relevant jurisdiction (state, territory), including the taxpayer submitting the Report by IHC country.

It is also worth noting the changes to the form of the Report by IGC countries, namely

- column 1.3 "Code of the type of notification" is deleted;

- column 8 "Code of the reporting status of an IGC participant" - it is now possible to select a new code CBC703, which determines the respective status of the taxpayer and is indicated in cases of

submission of the Report by IHC country is not required from such an IHC (in accordance with the legislation of the parent company of the IHC);

there is an effective international treaty between Ukraine and the relevant foreign jurisdiction of tax residence of the parent company of an MHC containing provisions on the exchange of information for tax purposes, but the relevant QCAA has not entered into force as of the end of the financial year for which the Report by country is to be submitted;

there is a valid international treaty between Ukraine and the relevant foreign jurisdiction of tax residence of the parent company of the IHC containing provisions on the exchange of information for tax purposes, but there are facts of systematic failure to comply with the relevant QCAA;

- column 22 "Participant status code in an international group of companies" - it is now possible not to fill in this column if the status of an IHC participant does not fall under any of the values;

- columns 26 - 29.2 - data on addresses of an IHC member in fixed and free forms - may be repeated depending on the number of types of addresses of IHC members;

- column 30 "Information on the type (types) of economic activity" - the possibility of mandatory display of one or more codes SVS501-CBC has been clarified

In columns 11, 11.1, 23, 23.1, 24.1, 24.2, 25.1, 25.3, 27, 31.3, notes 2, 3, sections I, II, the words "state (territory)" in all cases and numbers are replaced by the words "jurisdiction (state, territory)".

Taking into account the above, the Country-by-Country Reports for the financial year 2022 (ending on January 1 - December 31, 2022) submitted by taxpayers before the entry into force of Order No. 709 and the introduction of the possibility to submit the Country-by-Country Report in the updated form are considered valid.

In addition, we would like to inform you that the revised XML schema of the Report by country of the IGC and its description (J1800202, J1820102, J1820102 with the note "for developers)" are published on the STS web portal in the section: Home/Electronic Reporting/To Taxpayers on Electronic Reporting/Information and Analytical Support/Register of Electronic Forms of Tax Documents.

The introduction of electronic formats for submitting the Report by IGC countries in the updated form will be implemented after the software is finalized.

Buhgalter 911 notes that the content of the author's materials may not coincide with the policy and opinion of the editorial team. The authors of the published materials include not only representatives of the editorial team.

The information presented in a particular publication reflects the position of the author. The editorial team does not interfere with the author's materials, does not edit the texts, and is therefore not responsible for their content.