The State Tax Service clarifies the nuances of filling out the Notification on CFC controllers

A controlled foreign company is any legal entity registered in a foreign country or territory that is recognized as being under the control of a Ukrainian individual or a Ukrainian legal entity.

Pursuant to subparagraph 392.5.5 of paragraph 392.5 of Article 392 of Section I of the TCU, an individual (legal entity) - a resident of Ukraine is obliged to notify the controlling authority of:

♦ each direct or indirect acquisition of a share in a foreign legal entity or the beginning of actual control over a foreign legal entity, which leads to the recognition of such individual (legal entity) as a controlling person in accordance with the requirements of this article;

♦ establishment, creation or acquisition of property rights to a share in the assets, income or profit of an entity without the status of a legal entity;

♦ each alienation of a share in a foreign legal entity or termination of actual control over a foreign legal entity, which leads to the loss of recognition of such individual (legal entity) as a controlling person in accordance with the requirements of this Article;

♦ liquidation or alienation of property rights to a share in the assets, income or profit of an entity without the status of a legal entity.

The notification shall be sent to the supervisory authority at the main place of registration of the individual (legal entity) - resident of Ukraine within 60 days from the date of such acquisition (commencement of actual control) or alienation (termination of actual control).

The form and procedure for sending the Notification to the supervisory authority are approved by the Order of the Ministry of Finance dated 22.09.2021 No. 512.

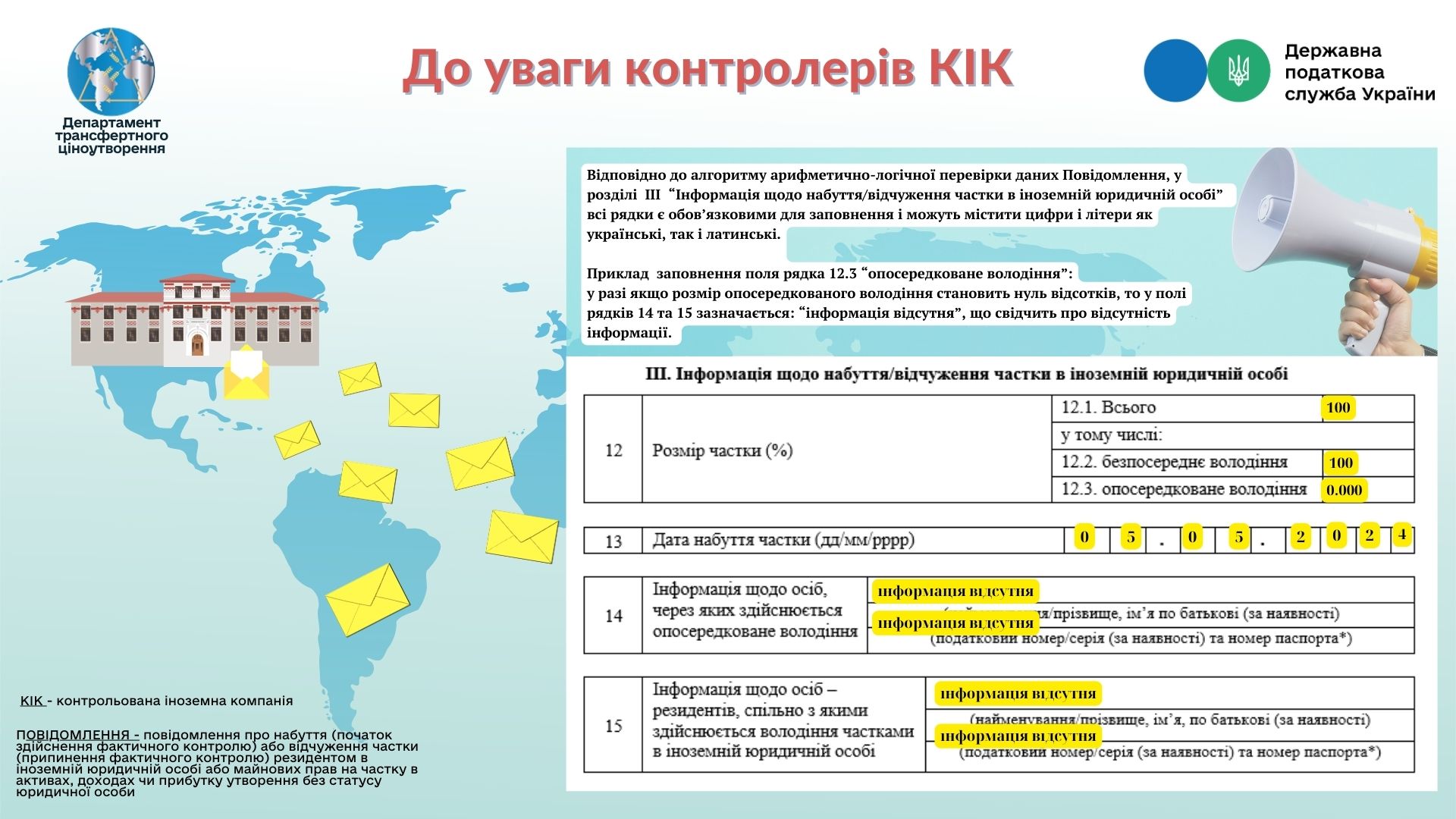

In order to minimize mistakes made by individuals and legal entities submitting the Notification, the State Tax Service of Ukraine informs that in accordance with the algorithm of arithmetic and logical verification of the Notification data in section III " Information on the acquisition/alienation of a share in a foreign legal entity", all lines are mandatory and may contain numbers and letters, both Ukrainian and Latin.

Thus, when filling in the field of line 12.3 "indirect ownership", if the amount of indirect ownership is zero percent, it is advisable to indicate in the field of lines 14 and 15: "no information available", which indicates that no information is available.

Buhgalter 911 notes that the content of the author's materials may not coincide with the policy and opinion of the editorial team. The authors of the published materials include not only representatives of the editorial team.

The information presented in a particular publication reflects the position of the author. The editorial team does not interfere with the author's materials, does not edit the texts, and is therefore not responsible for their content.