For the attention of CFC controllers - individuals!

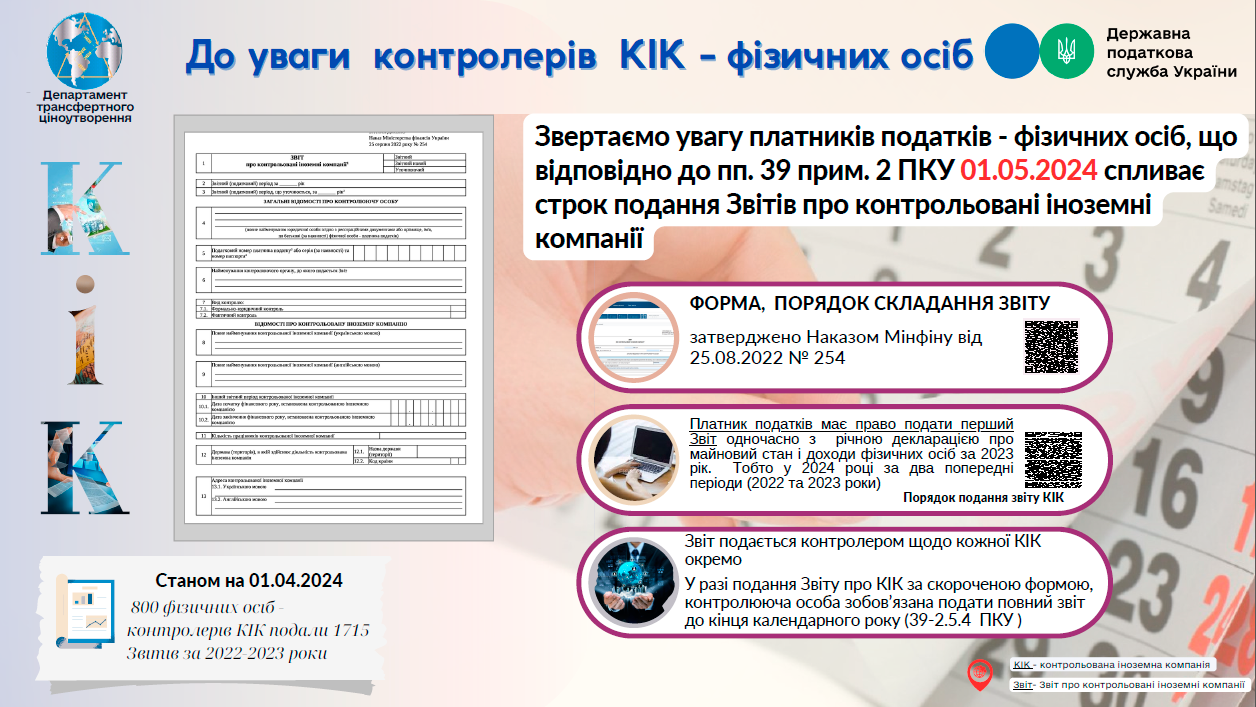

The State Tax Service of Ukraine informs that the campaign for submission of Reports on Controlled Foreign Companies (hereinafter referred to as CFCs) for the 2022 and 2023 reporting periods by controlling persons - individuals is currently underway.

Thus, in 2023, 1116 Reports on Controlled Foreign Companies (hereinafter referred to as the CFC Report) and 509 CFC Reports in the shortened form were submitted.

For the purposes of tax control over the profit taxation of a controlled foreign company, a reporting (tax) period is a calendar year or another reporting period of a CFC ending within a calendar year.

The first reporting (tax) year is 2022 (if the reporting year does not correspond to a calendar year, the reporting period starting in 2022).

We remind you that the CFC Report must be submitted by controlling persons simultaneously with the submission of the annual declaration of property and income.

In accordance with subparagraph 49.18.4 of paragraph 49.18 of Article 49 of the Tax Code of Ukraine (hereinafter - the Code), declarations of property status and income are submitted for a calendar year - by May 1 of the year following the reporting year.

At the same time, clause 54 of subsection 10 of section XX "Transitional Provisions" of the Code establishes the following peculiarities of application of the provisions on taxation of CFC's income during the transition period: the first reporting (tax) year for the Report is 2022 (if the reporting year does not correspond to a calendar year, the reporting period starting in 2022). The controlling persons have the right to submit the 2022 Report to the supervisory authority simultaneously with the submission of the annual property and income tax return or corporate income tax return for 2023, with the inclusion of the adjusted profit of the CFC specified in such report, which is subject to taxation in Ukraine, in the indicators of the relevant declarations for 2023. In this case, no penalties and/or fines are applied.

The CFC report must be accompanied by duly certified copies of the CFC's financial statements confirming the amount of the CFC's profit for the reporting (tax) year.

In accordance with subparagraph 392.5.2 of paragraph 392.5 of Article 392 of the Code, if the deadlines for the preparation of financial statements in the relevant foreign jurisdiction expire later than the deadlines for filing an annual property and income tax return or corporate income tax return, such copies of the financial statements of the controlled foreign company shall be submitted together with the annual property and income tax return or corporate income tax return for the next reporting (tax) period.

At the same time, the CFC Report shall contain all the necessary information on the results of the CFC's activities for the relevant reporting period (based on the accounting and/or interim financial statements).

Also, if such a person is unable to ensure the preparation of CFC's financial statements and/or calculation of CFC's adjusted profit by the date of the deadline for submission of the annual declaration of property and income or corporate income tax return, such a person shall submit a report on CFC in a shortened form, which contains only the information provided for in subparagraphs "a" - "c" of subparagraph 392.5.3 of paragraph 392.5. of Article 392 of the TCU.

In case of submission of the CFC Report in a shortened form, the controlling person is obliged to submit the full CFC Report by the end of the calendar year following the reporting (tax) year.

It should be remembered that the CFC Report is submitted for each controlled foreign company separately and exclusively in electronic form.

At the same time, clause 120.7 of the TCU establishes financial liability for a tax offense, in particular

Failure to submit a CFC report entails a fine in the amount of 100 times the minimum subsistence level for an able-bodied person as of January 1 of the tax period (in 2024 - UAH 302,800);

untimely submission of the CFC report by the controlling person entails a fine in the amount of one subsistence minimum for an able-bodied person established by law as of January 1 of the tax year for each calendar day of non-submission, but not more than 50 subsistence minimums for an able-bodied person established by law as of January 1 of the tax year (in 2024 - up to UAH 151,400).

At the same time, subparagraph 54 of subsection 10 of section XX of the TCU provides that

- penalties and fines for violation of the requirements of Article 392 of the Code in determining and calculating the profit of a CFC shall not be applied for the results of 2022 - 2023 reporting (tax) years;

- administrative and criminal liability for any violations related to the application of Article 392 of the TCU shall not be applied to the taxpayer and its officials for the reporting (tax) years 2022 - 2023.

Buhgalter 911 notes that the content of the author's materials may not coincide with the policy and opinion of the editorial team. The authors of the published materials include not only representatives of the editorial team.

The information presented in a particular publication reflects the position of the author. The editorial team does not interfere with the author's materials, does not edit the texts, and is therefore not responsible for their content.