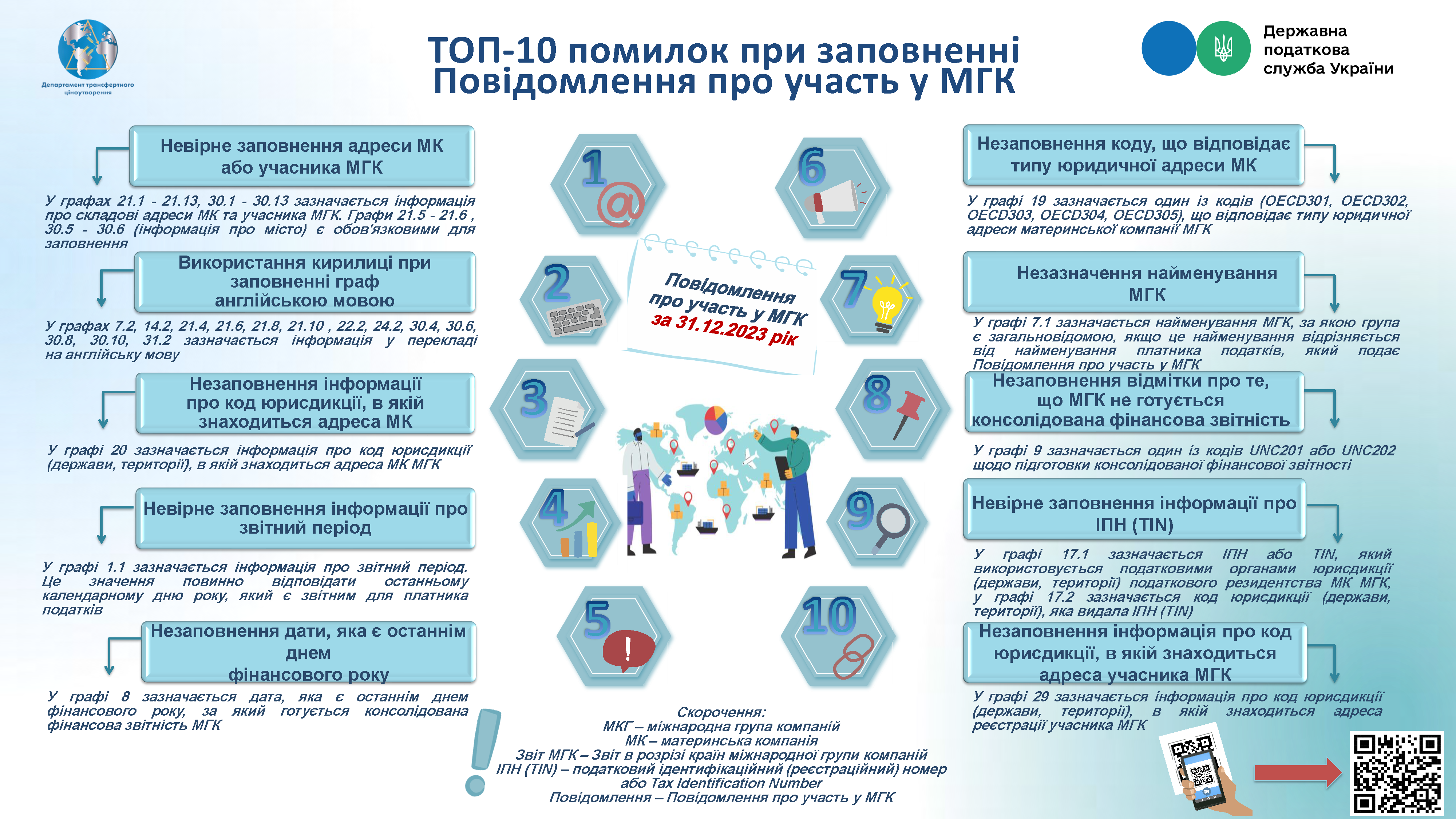

TOP - 10 mistakes when filling out the Notice of participation in an international group of companies

Based on the annual monitoring of the submitted Notifications on participation in an international group of companies (hereinafter referred to as the "IGC"), the STS summarized the most common mistakes made by taxpayers when filling out the Notification on participation in an IGC.

The TOP-10 includes the following mistakes (depending on the frequency of their occurrence by taxpayers):

♦Incorrect filling in the address of the parent company (hereinafter referred to as the "MC") or an IGC participant - in columns 21.1 - 21.13, 30.1 - 30.13, information on the components of the address of the MC and the IGC participant is indicated. Columns 21.5 - 21.6, 30.5 - 30.6 (information about the city) are mandatory;

♦use of the Cyrillic alphabet when filling in the columns in English - in columns 7.2, 14.2, 21.4, 21.6, 21.8, 21.10, 22.2, 24.2, 30.4, 30.6, 30.8, 30.10, 31.2, the information shall be translated into English;

♦failure to fill in the information on the code of the jurisdiction in which the address of the IC is located - column 20 contains information on the code of the jurisdiction (state, territory) in which the address of the IC of IHC is located;

♦incorrect filling in of information about the reporting period - information about the reporting periodshall be indicated in column 1.1. This value must correspond to the last calendar day of the year that is the reporting year for the taxpayer;

♦Failure to fill in the date that is the last day of the financial year - column 8 shall indicate the date that is the last day of the financial year for which the consolidated financial statements of the IHC are prepared;

♦failure to fill in the code corresponding to the type of legal address of the IC - in column 19, one of the codes (OECD301, OECD302, OECD303, OECD304, OECD305) corresponding to the type of legal address of the IC of IHC shall be indicated;

♦failure to indicate the name of the IGC - column 7.1 shall indicate the name of the IGC by which the group is generally known, if this name differs from the name of the taxpayer submitting the Notice of participation in the IGC;

♦Failure to fill in the note that the IGC does not prepare consolidated financial statements - one of the codes UNC201 or UNC202 regarding the preparation of consolidated financial statements shall be indicated in column 9;

♦incorrect filling in of information on TIN (TIN) - column 17.1 shall indicate the TIN or TIN used by the tax authorities of the jurisdiction (state, territory) of tax residence of IC ICG, column 17.2 shall indicate the code of the jurisdiction (state, territory) that issued the TIN (TIN);

♦failure to fill in the information on the code of the jurisdiction in which the address of the IGC participant is located - column 29 shall contain information on the code of the jurisdiction (state, territory) in which the registration address of the IGC participant is located, provided that the Report by IGC country is submitted by an authorized IGC participant and the total consolidated income of the IGC for the financial year preceding the reporting year is equal to or exceeds the equivalent of EUR 750 million.

In order to simplify the perception of information, the State Tax Service has developed an infographic that contains both examples of the most common mistakes when filling out the Notification on participation in the IGC and specific advice on how to prevent them in the future.

We recommend that you use this information to avoid mistakes when filling out the above notification. It is the independent detection and timely correction of errors that will protect taxpayers from negative consequences in the form of fines.

It should be noted that Article 120 of the TCU provides for the liability of taxpayers for failure to submit, late submission or provision of inaccurate information in the Notification on participation in the IGC.

As an example, in accordance with clause 120.5 of the TCU, the fine for providing false information in the Notification on participation in the IGC is 50 times the subsistence minimum for an able-bodied person established by law as of January 1 of the tax (reporting) year, in particular, for 2023 - UAH 134,200 (50 x UAH 2,684).

At the same time, the penalty provided for in paragraph 120.5 of the TCU does not apply if the taxpayer submitted a Notice of Participation in an IGC and/or a Report by IGC country with errors that did not affect the correct identification of the state or territory where one or more IGC participants are residents and/or the correct identification of each of the participants of the relevant IGC, and/or on the correct identification of the jurisdiction of submission of the Report by IGC country, and such payer corrected the errors by submitting a clarifying Notice of participation in IGC and/or a report by IGC country independently or no later than 30 calendar days from the date of receipt of the notification of the supervisory authority on the errors detected in the Report by IGC country.