Frequently asked questions - answers on the formation of a standard audit file (SAF-T UA)

1. How to determine the type of transaction, namely the signs of the first event?

Pursuant to the Procedure for Submission of Documents of a Large Taxpayer in Electronic Form, approved by Order of the Ministry of Finance No. 1393 dated November 07, 2011 (hereinafter - the Procedure), the subsection "Transaction Reference Books" provides for a description of the types of business transactions carried out by a business entity, with the relevant symbols of transactions and their characteristics.

Subsection 2.2 "Transaction Reference Books" of Section II "Reference Books" in note 2 states that the element "TransactionType" of the subsection "Transaction Reference Books" shall contain the appropriate symbol or coding of transactions. When providing the type and description of transactions related to the purchase/sale of goods, works/services, the appropriate distinction is made between these transactions, taking into account which event (transfer of funds (additional sign for the conditional designation of the transaction - "C") or receipt or delivery of goods, works/services (additional sign for the conditional designation of the transaction - "P")) occurred first (if the entity uses other signs or coding of transactions that allow for the above distinction, they can be applied).

The Appendix to the Detailed Technical Description of SAF-T UA Elements contains a separate TransactionType directory, which can be used as an example of how to fill in the elements of the TransactionFeatures subsection.

This reference book provides examples of types and descriptions of transactions that allow distinguishing transactions related to the purchase/sale of goods, works/services by the first event.

If the entity's accounting system uses other features or transaction coding (including for partial subscriptions), such features or transaction codes can be used when setting up data export.

2. What information should be displayed in the Analytical account type code field?

According to paragraph 3.3.3 "General Ledger Accounts" of section 3 "Detailed description of structure elements with reference to the XSD scheme" of the Detailed technical description of SAF-T UA elements, information on the applied accounts/subaccounts/analytical accounting accounts for conducting business activities of the entity is displayed, indicating in the context of each account, analytical account, their numbers, names, dates of creation of accounts (accounts/subaccounts/analytical accounts) and the opening balance as of the beginning of the period, with a breakdown by debit and credit of these accounts/subaccounts/analytical accounts.

The chart of accounts for accounting for assets, capital, liabilities and business transactions of enterprises and organizations, approved by Order of the Ministry of Finance of Ukraine No. 291 dated 30.11.1999, is used by enterprises, organizations and other legal entities regardless of ownership, organizational and legal forms and types of activities, as well as branches, departments and other separate subdivisions of legal entities that are separately accounted for.

Subaccounts to synthetic accounts are introduced by enterprises independently based on the needs of management, control, analysis and reporting.

Account numbers and titles of accounts/subaccounts/analytical accounts are reflected in SAF-T UA in accordance with the chart of accounts of the entity.

At the same time, the numbers of accounts/subaccounts in accordance with the chart of accounts of the entity (except for banks and public sector entities) must be a standard number in accordance with the table of accounts for accounting for capital, liabilities and business transactions of enterprises (StandardAccountlD).

The numbers of subaccounts in the chart of accounts of an entity may differ from the numbers of standard subaccounts.

If the account/subaccount number according to the chart of accounts of the entity is the same as the standard account/subaccount number, the matching still needs to be performed.

To group accounts/subaccounts that are relevant for financial statement reconciliation, the conditional account category code (GroupingCategory) is used:

A1L - a synthetic account (first-order account) that has lower-order subaccounts;

- A2L - a subaccount (second-order account) that has lower-order subaccounts;

- A3L - a subaccount (third-order account) that has subaccounts of lower order;

- A - an account/subaccount that does not have subaccounts of lower order.

In particular, in accordance with clause 3.3.9 "AnalysisTypeTable" of section 3 "Detailed Description of Structure Elements with Reference to XSD Schema" of the Detailed Technical Description of SAF-T UA Elements, the reference book contains information on types and types of analytics (analytical accounts) and is used for analytical accounting of transactions.

3. What are the types of analytical accounts?

According to part five of Article 8 of the Law of Ukraine "On Accounting and Financial Reporting in Ukraine", the company independently approves the rules of document flow and technology for processing accounting information, an additional system of accounts and registers of analytical accounting.

Pursuant to part three of Article 9 of the Law of Ukraine "On Accounting and Financial Reporting in Ukraine", the information contained in the primary documents accepted for accounting is systematized in the accounting accounts in the synthetic and analytical accounting registers by double entry in the interrelated accounting accounts. The data of analytical accounts shall be identical to the corresponding accounts of synthetic accounting at the end of the last day of each month.

The detailed technical description of the SAF-T UA elements stipulates that the AnalysisTypeTable subsection of the MasterFiles section contains information on the types and types of analytics (analytical accounts) and is used for analytical accounting of transactions. Example: storage location, project, department, supplier, employees, types of expenses, etc.

Therefore, it is advisable to indicate in the AnalysisTypeTable subsection the data from the Cost Center Master Data, Project definition, etc. tables (SAP), which are used to further detail information about transactions.

4. Does the company have the ability to independently change the directory of the element "Inventory/Product Category Identifier (Goods/Work, Service)" (GoodsServicesID), as an example? For example, add their own values or change or combine existing values (for example, combine works and services)? Will this directory be unified for all enterprises?

MovementTypeTable (clause 3.3.10)

The GoodsServicesID has a restriction on the set of values (enumeration) for the inventory/product category identifier (goods/works, services). Therefore, when setting up data export, it is necessary to configure (map) the own objects of the corresponding directories with the restrictions on the set of values for this element: 1 - goods, 2 - work, service.

5. Does the company have the opportunity to independently change the reference book of the "MovementType" element? For example, add your own values or change existing ones. Will this directory be unified for all companies?

MovementOfGoods (section 3.5.4)

The directories listed after the "Structures" tab in the appendix to the Detailed Technical Description of SAF-T UA elements are examples of filling in (optional) (for example, the directories "InvoiceType", "MovementType) or limited lists of identifiers (mandatory) that are used to fill in the corresponding subsections of the MasterFiles section of SAF-T UA (for example, the TableOfAccounts and DepreciationMethod directories).

Therefore, when filling out the MovementTypeTable subsection of the MasterFiles section of SAF-T UA, an enterprise can customize (compare) its own objects of this directory with examples of filling out or use its own directory.

6. Which elements to fill in in the Customer, Supplier, Owner subsections in case of internal inventory movement.

According to the Detailed Technical Description of SAF-T UA elements, in the subsection "Inventory transactions" (MovementOfGoods), based on primary documents, information is indicated in the context of transactions carried out with material assets with the obligatory indication of the numbers and names of accounts/subaccounts where they are accounted for, their quantity, price and value, as well as disclosure of other information.

If inventory transactions are not with a counterparty (e.g., internal transfer, revaluation, shortages and losses, etc.), it is not necessary to fill in the counterparty's EDRPOU/RNOKPP code and counterparty name/surname, first name and patronymic (if any).

7. In what currency should inventory import transactions be recorded (in the currency of purchase or in the accounting currency (UAH))?

According to the third part of Article 9 of the Law of Ukraine "On Accounting and Financial Reporting in Ukraine", the information contained in the primary documents accepted for accounting is systematized in the accounting accounts in the synthetic and analytical accounting registers by double entry in the interrelated accounting accounts. Foreign currency transactions are also recorded in the currency of settlement and payment for each foreign currency separately.

When specifying information on the import of inventory in the "Monetary value of the product net of taxes" element (InvoiceLineAmount) of the "PurchaseInvoices" subsection, information is also displayed in the currency of settlement and payment.

In the Physical Stock subsection of the MasterFiles section and the MovementOfGoods subsection of the SourceDocuments section, information on stocks and stock movements is displayed in the Ukrainian currency.

8. What payment methods can be used for the PaymentMethod element? Is there a value directory?

Based on the primary documents, information on the received/transferred funds of the business entity is indicated with the payment methods, corresponding accounts and other information on the characteristics of the settlements made in terms of payments.

The PaymentMethod field indicates cash or non-cash. There is no value directory.

9. What should I specify in the Payment Type element? Is there a value directory?

The element contains information detailing the payment, namely, it is advisable to indicate the types of payment under the contract, for example, advance payment, postpayment, credit payment; budget payment, etc. There is no value directory.

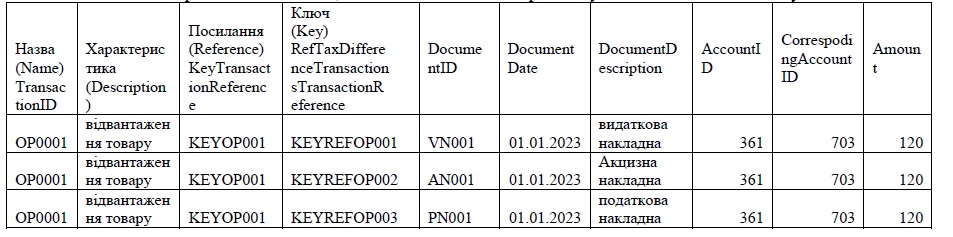

10. In case TransactionID = DocumentID, how to display the above elements?

In practice, there can be more than one DocumentID to one TransactionID, and the schema indicates that the TransactionID has the mandatory character, repetition 1...1, that is, in order to display information in the context of a document, you need to display more than one TransactionID.

For example:

Primary document number Invoice No. 1, general ledger package journal No. 1

Primary document number Invoice #2, general ledger package journal # 1

According to the draft SAF-T UA amendments to TransactionID, it is a unique transaction identifier defined by the software used by the business entity. A reference to this indicator is contained in the KeyTransactionReference variable under the RefAssetTransaction key. It is these variables that determine the linkage of a transaction to related documents. Therefore, if the software correctly determines the type of variables and provides the correct key types, the indicator can be linked to several types of documents.

11. In which subsection should payroll be reflected in section III General Ledger Entries or in reference book II.7 TaxTable?

Section II.7 TaxTable contains the necessary parameters for determining the name, type and rate of tax, which should be used to link to them when posting accounting transactions to the accounts in chronological order. For example, determining the required amount of tax depending on the amount of accrued wages or determining the exemption for calculating income tax or military duty for an individual employee.

Thus, information on payroll should be displayed in section III General Ledger Entries, and in directory II.7 TaxTable, display information on taxes related to payroll.

Thus, specifying all the parameters of taxes/fees to be accrued and paid by the company is a prerequisite for the correct allocation of all relevant indicators to the accounting accounts.

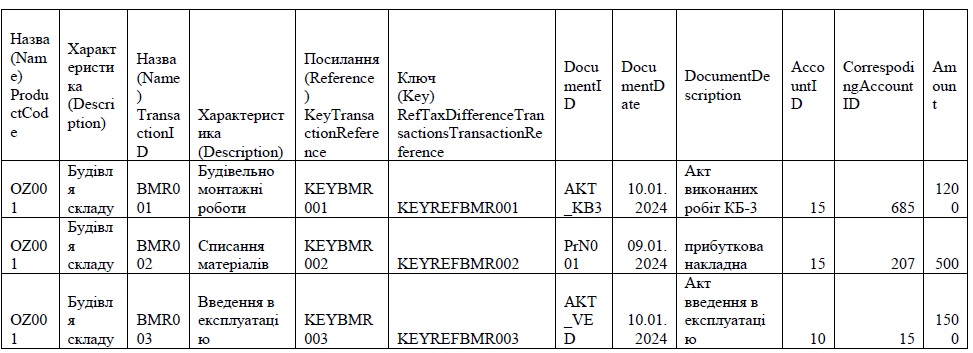

12. In reference book II.14 Non-current assets (Assets), the AssetID and AccountID fields are mandatory, repetition 1...1. An enterprise can have two accounting accounts for one asset code. For example, there was an asset (premises), it was built, the calculation was carried out on account 15, then the asset was put into operation, the account changes to 10, (the type of asset, group, etc.) How should the information on such an asset be displayed in the SAF-T UA file?

According to the accounting rules, an asset should be reflected in the appropriate accounting account, taking into account the chronology of changes in its value/quality/name. Therefore, if there were changes to the asset during the reporting/audited period, a prerequisite for identifying a particular transaction is a clear indication of the date and chronology of such changes to determine the correctness of the allocation to the appropriate accounting account using the unique TransactionID defined by the software used by the business entity. The reference to this indicator is contained in the KeyTransactionReference variable by the RefAssetTransaction key. These variables determine the linkage of the transaction to related documents and objects.

13. How to fill in the information in the reference books II.2 TransactionFeatures and II.10 MovementTypeTable if there was a change in their content during the year (addition, change of names). Did you change the value of 1P - Purchase of products/works/services (first event - receipt) to 1Z?

The TransactionType variable is defined in section II.2 of the Handbooks and is used throughout the audit file, and therefore cannot be changed, since its change for one transaction may lead to a change in all types of transactions in general.

14. Does the company have the ability to enter its own tax codes? Is there a standard (mandatory) directory of tax codes that the taxpayer must follow when keeping records?

The TaxTable subsection of the MasterFiles section of SAF-T UA should be filled in using a limited list of TaxType and TaxCode identifiers related to VAT, which are provided in Annex 2 to the Detailed Technical Description of SAF-T UA Elements. At the same time, the tax codes for VAT correspond to the rate codes used when filling out tax invoices.

Therefore, when setting up data exports, it is advisable to link (map) the corresponding codes to the tax codes used by the business entity.

Codes of other taxes can be filled in in accordance with the tax codes applied by the business entity.

15. Can a company submit the Accounting Policy to the State Tax Service as a single file, or should it be submitted by sections? What sections of the Accounting Policy must be submitted by the company? Are there any requirements?

According to the Structure for the provision of electronic documents (information) of the LTO (Standard Audit File

(SAF-T UA)), set forth in the appendix to the Procedure, the Accounting Policy subsection shall contain information on the elements of the accounting policy of the entity in the period for which the SAF-T UA is formed, with the details of the order(s) on the accounting policy (date, number) for the relevant reporting periods (and on amendments to them, if any).

It is also necessary to indicate which accounting standards are used by the entity for accounting - UAS/IAS, and the use of account classes.

The information is to be filled in in tabular form according to the sample provided, and all information provided for in the order(s) on accounting policy shall be reflected. The "Element" column includes information on depreciation methods, the procedure for forming provisions, including provisions for doubtful debts, methods for assessing the disposal of inventories, determining materiality thresholds, conducting inventories, the procedure for forming other financial reporting indicators, etc. (the reflection of which is provided for by regulations on the accounting policy of the enterprise or the Conceptual Framework for the Preparation and Presentation of Financial Statements (for IFRS)).

Thus, the information required by the regulations on the company's accounting policy or the Conceptual Framework for Preparation and Presentation of Financial Statements is subject to mandatory disclosure.

The technical implementation of SAF-T UA does not provide for the provision of copies of administrative documents approving the accounting policy of the entity in electronic form.

16. How should such data be reflected in the AssetLifeMonth element if the life of a non-current asset has changed in the reporting period?

The XSD SAF-T UA scheme does not provide for the reflection of changes in the parameters of the useful life (operation) of non-current assets in the element "Useful life (operation) in years" (AssetLifeYear) or "Useful life (operation) in months" (AssetLifeMonth) of the "Assets" subsection of the "MasterFiles" section.

It is advisable to reflect in the SAF-T UA file the useful life (operation) of non-current assets at the beginning of the period (for new additions - at the date of commissioning).

17. What DepreciationMethod should be specified for fixed assets that are not depreciated (e.g., land)?

According to the Detailed technical description of SAF-T UA elements, the DepreciationMethod (simple; maxLength 35; Optional) element of the Assets subsection of the MasterFiles section is filled in if relevant information is available.

18. Can we independently modify the reference book of the element "Identifier of the category of stock/products (goods/works, services)" (GoodsServicesID), as an example, given above? For example, add your own values or change or combine existing ones (for example, combine works and services)? Will this directory be unified for all enterprises? MovementTypeTable (clause 3.3.10)?

The GoodsServicesID has a restriction on the set of values (enumeration) for the inventory/product category identifier (goods/works, services). Therefore, when setting up data export, it is necessary to configure (map) the custom objects of the corresponding directories with the restrictions on the set of values for this element: 1 - goods, 2 - work, service.

19. In which subsection of the SAF-T UA file should information on the company's capital investments be displayed (account 15)

Information on the accounting of all non-current assets (fixed assets, other non-current tangible assets, intangible assets, financial investments, capital investments, depreciation, etc.) (including off-balance sheet assets) should be reflected in the "Non-current assets" subsection.

20. How to fill in the TaxInformation element of Section III General Ledger Entries if there are tax consequences for both VAT and excise tax.

When disclosing information on the entity's accounting entries for business transactions that involve the simultaneous accrual of several taxes (for example, VAT and excise tax), the relevant tax information should be indicated by repeating the TaxInformation element.

21. In which subsection of the SAF-T UA file should lending transactions be reflected?

Information on lenders (banks) with which the business entity had business relations should be reflected in the "Suppliers" subsection, accrued interest - in the "PurchaseInvoices" subsection, received / transferred funds - in the "Payments" subsection, accounting entries in the context of each individual business transaction - in the "Accounting transactions" subsection.

22. In which subsection of the SAF-T UA file should operating and financial leasing transactions be reflected?

Information on the accounting of assets for the right to use under lease agreements should be reflected in the Assets and AssetTransactions subsections, and short-term and long-term lease obligations should be reflected in the Suppliers subsection, accrual of liabilities in accordance with the contractual terms of the lease (including VAT) - in the PurchaseInvoices section, and accounting entries for each individual business transaction - in the Accounting transactions section.