New fines for violations of transfer pricing reporting

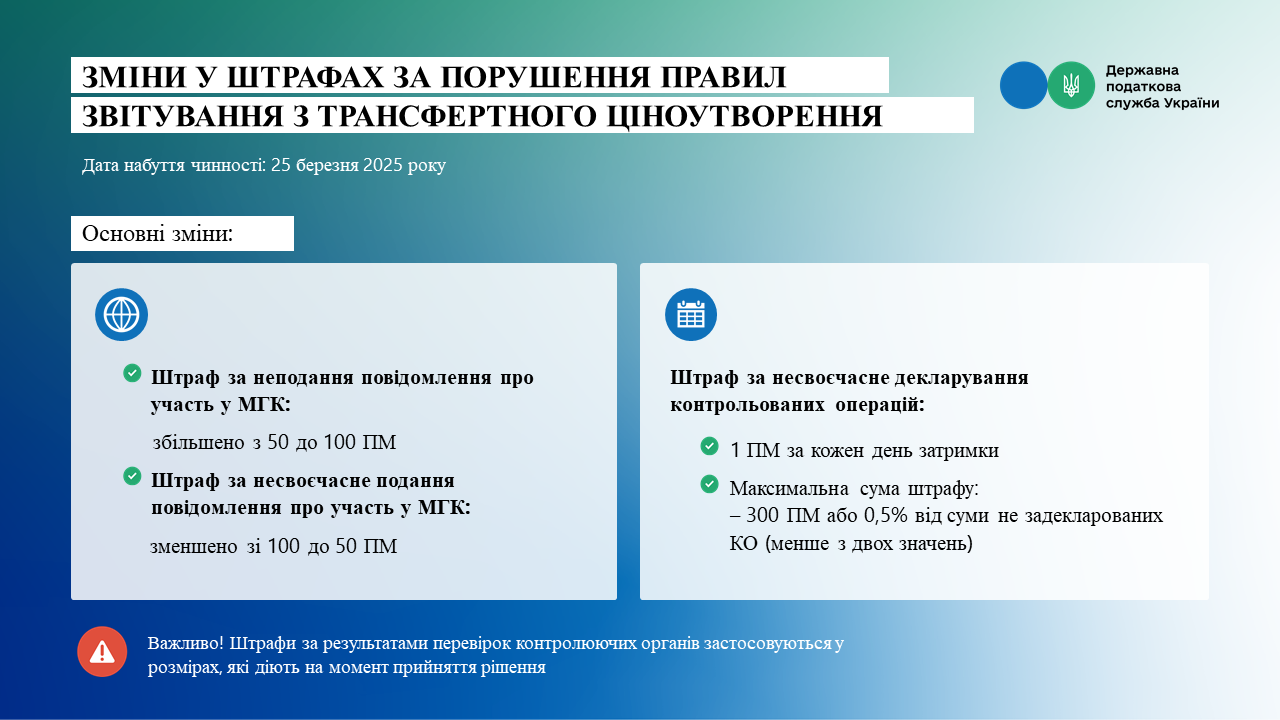

On March 25, 2025, amendments to the Tax Code will come into force regarding new amounts of certain fines for violation of transfer pricing reporting deadlines.

What should you pay attention to?

- The penalty for failure to submit a notification of participation in an international group of companies has been increased from 50 to 100 subsistence minimums for an able-bodied person as of January 1 of the reporting year. The penalty for late submission of the relevant notification has been reduced from 100 to 50 minimum incomes (para. 120.6(8) of the Tax Code).

- The penalty for late declaration of controlled transactions in the submitted TP report (if a clarifying report is submitted) is 1 PM for each day of delay. However, the total amount of the fine may not exceed 300 PM or 0.5% of the amount of undeclared controlled transactions, and the lower value shall apply (paragraph four of clause 120.6 of the TCU).

Important: penalties based on the results of inspections by the controlling authorities are applied in the amounts that are in force at the time of the decision to apply them.

Be careful and submit your reports on time!