Customs payments when importing a vehicle

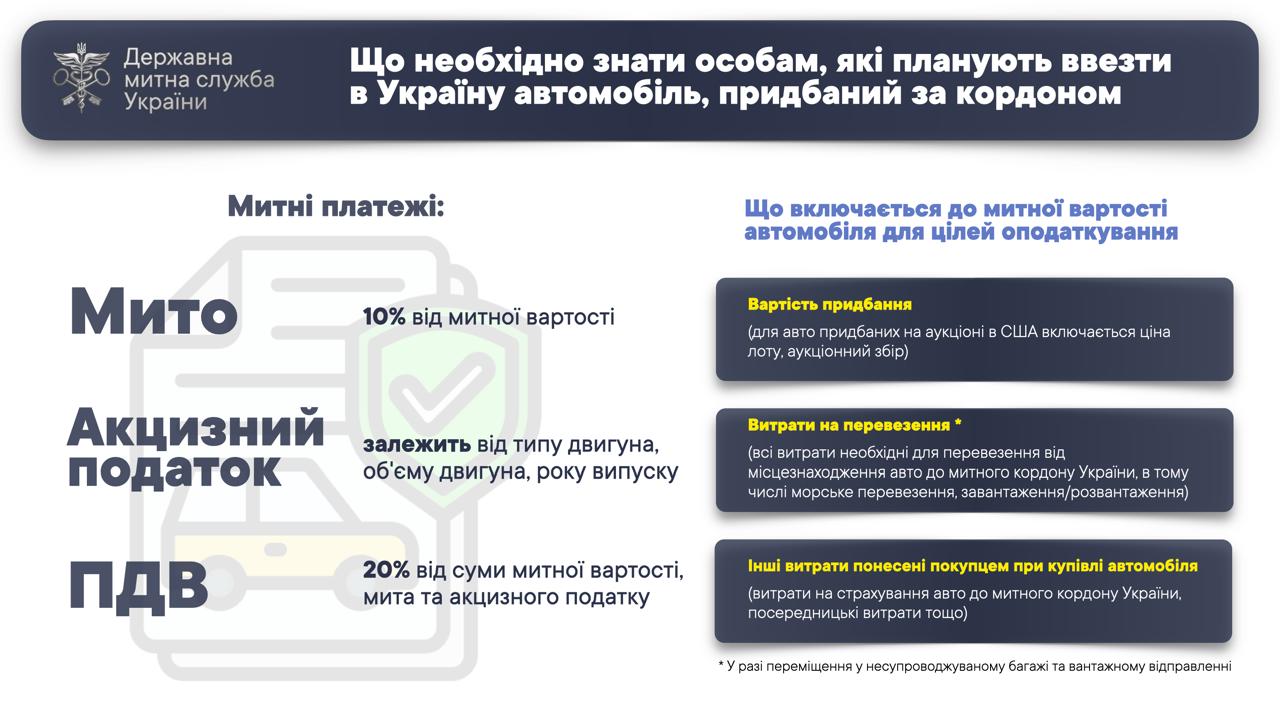

When importing a vehicle, customs duties are paid, which consist of customs duty, excise tax, and value added tax.

While the amount of excise tax depends on the year of manufacture, engine type and volume, customs duty and value added tax are paid depending on the costs incurred by the buyer in purchasing the vehicle.

According to the Customs Code of Ukraine, in particular Chapter 9, such expenses include all payments made or to be made by the buyer of the goods being valued to the seller or in favor of the seller through third parties and/or to persons related to the seller to fulfill the seller's obligations (Article 58 of the Code). Such expenses include the cost of purchasing a vehicle, transportation costs, insurance, auction fees in case of purchase at auction sites, etc.

For more information on certain issues of customs clearance of vehicles, please follow the link: https://is.gd/wHB1KS.